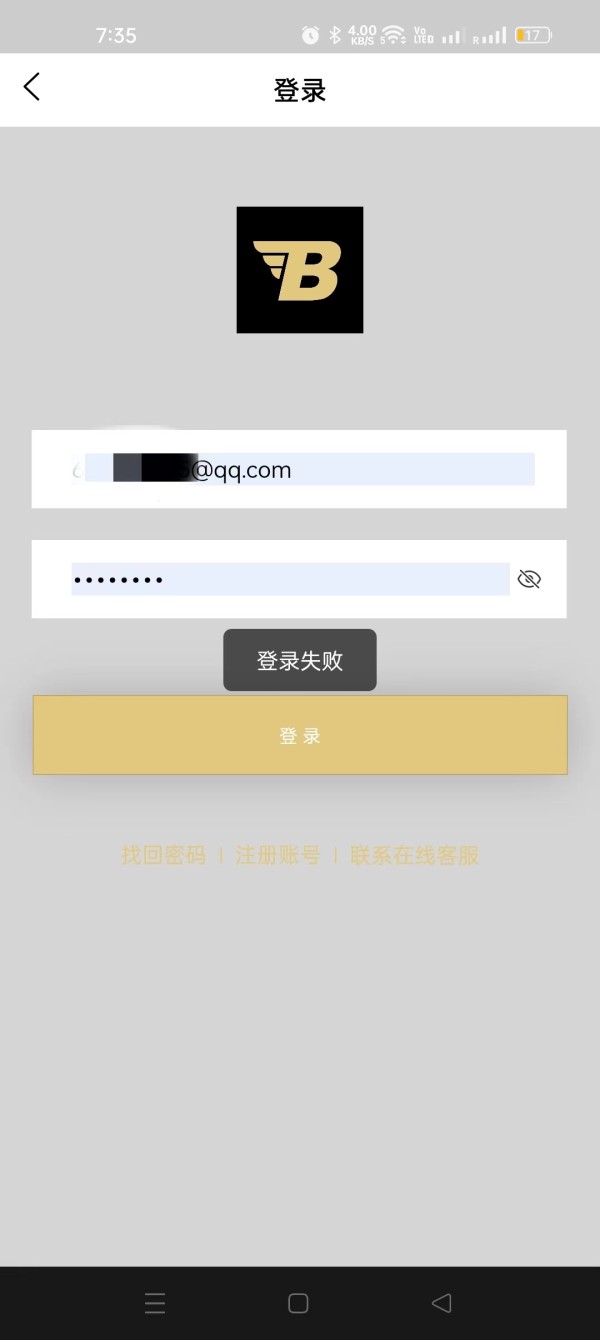

BIT2673586475

2021-04-27 07:51

To withdraw coins, you have to top up the same amount of coins, and you can only withdraw them. Who can believe this?

Exposure

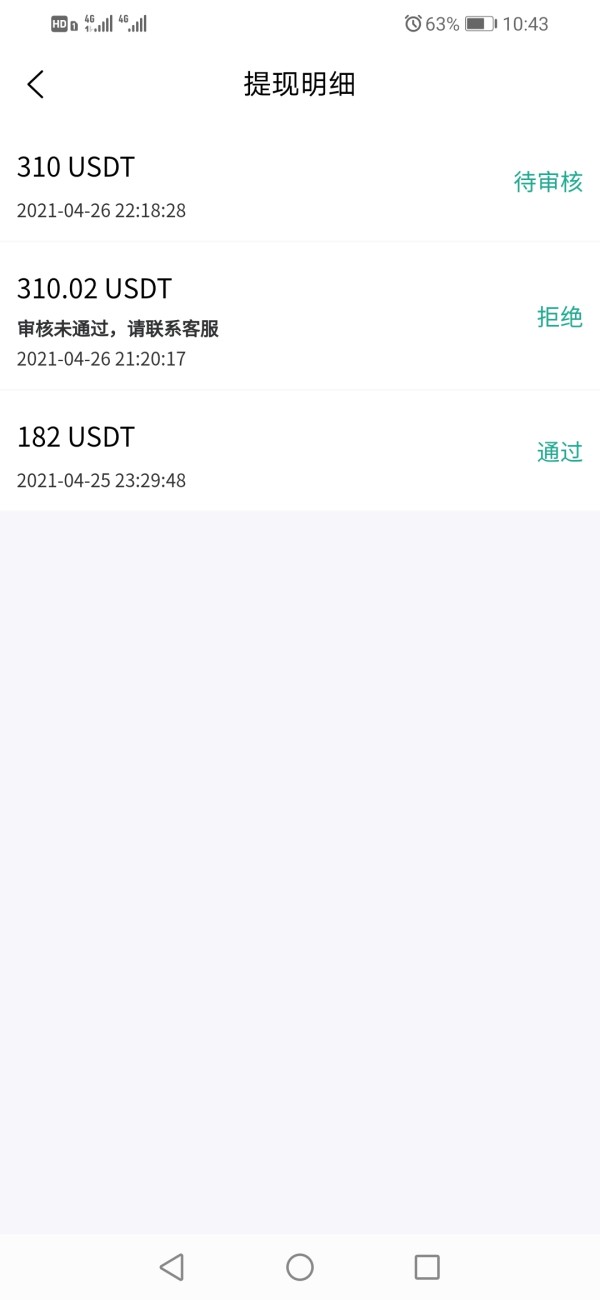

BIT2673586475

2021-04-26 23:30

If you want to withdraw coins, you have to top up, the black platform

Exposure

Chibueze

2023-11-10 10:38

Binance is a safe and reliable mean of trading and it has brought wealth to me and many other

Neutral

Nandhi

2023-11-22 20:21

Superb response in this app,lov it one ,nice 👍 certificate intha app, exchange all of very good nice experience ,good performance in app. perfect project orders

Positive

Overview of BMEX

BMEX, or BitMex, is a cryptocurrency trading platform that was founded in 2014. The driving forces behind its establishment were three seasoned professionals: Arthur Hayes, Ben Delo, and Samuel Reed. The platform primarily offers its users the ability to trade Bitcoin and other cryptocurrencies using a system of contracts. BitMex is a Hong-Kong based company, but it caters to a global market, enabling trading services globally with some exceptions. At its core, it focuses on offering a robust trading infrastructure that is highly secure and reliable.

Pros and Cons

| Pros | Cons |

|---|---|

| Offers a diverse range of cryptocurrency contracts | Not available in some countries such as the United States |

| Highly secure and reliable trading infrastructure | Possibly overwhelming for beginner traders due to complexity |

| Founded by industry professionals | No fiat currency support |

| Caters to a global market | Contains a high level of risk, similar to other trading platforms |

Sure, here are the detailed descriptions of the pros and cons listed in the table for BMEX.

Pros:

1. Diverse Range of Cryptocurrency Contracts: BMEX offers a wide variety of cryptocurrency contracts, making it an ideal platform for users looking to diversify their cryptocurrency trading portfolios. This varied offering provides traders with the opportunity to speculate on the future prices of different cryptocurrencies.

2. Security and Reliability: BMEX places considerable emphasis on creating a secure and reliable trading environment. With advanced security protocols in place, users can trust that their assets and data are well-protected.

3. Founded by Industry Professionals: BMEX was established by industry veterans - Arthur Hayes, Ben Delo, and Samuel Reed. These founders brought their vast experience and knowledge into building the platform, lending confidence to its operations.

4. Global Market Reach: Despite being based in Hong Kong, BMEX provides trading services to users worldwide, increasing its appeal to a global user base.

Cons:

1. Availability: Unfortunately, BMEX does not extend its services to some countries, with notable exclusion being the United States. This restriction limits the platform's potential user base.

2. Complexity: While BMEX offers a myriad of trading options, its interface and functioning could prove overwhelming for beginner traders. The complexity associated may serve as a barrier for those new to cryptocurrency trading.

3. No Fiat Currency Support: BMEX doesn't feature support for trading with fiat currencies. So, users are limited to cryptocurrencies as the only form of assets on the platform.

4. High Level of Risk: Like all trading platforms, BMEX is not free from risks. Similar to other platforms, the volatile nature of cryptocurrencies can lead to significant losses, making it imperative for users to trade with caution.

Security

BMEX employs several security measures to ensure the safety of its platform and user assets. It utilizes the multi-signature deposit and withdrawal scheme which adds an extra layer of protection. The multi-signature process requires more than one key to authorize a Bitcoin transaction, making it more resistant to theft. Additionally, BitMex also makes use of Amazon Web Services's security features to protect the servers with SMS and two-factor authentication, as well as hardware tokens. BMEX assets are also kept in offline, air-gapped systems, far from potential online threats.

On top of these tangible security measures, BMEX also enforces mandatory withdrawals once a day. This limits the amount of assets that could possibly be affected within 24 hours if a security breach were to occur. Also, it utilizes a risk check system after every order placement to ensure account solvency, and employs 24/7 monitoring to quickly identify and respond to suspicious behaviors.

In terms of assessment, BMEX appears to be heavily focused on security, adopting both traditional and innovative practices to protect user assets and data. However, as with any trading platform, users should be aware of and comfortable with the inherent risks associated with cryptocurrency trading. Despite the extensive security measures, there is no absolute immunity against all potential security threats.

How Does BMEX Work?

BMEX operates as a peer-to-peer trading platform, providing a marketplace for users to trade contracts on various cryptocurrencies. The platform mainly trades in futures contracts, which allow traders to speculate on the future price of Bitcoin and other cryptocurrencies.

On BMEX, users do not buy and sell cryptocurrencies directly. Instead, they buy and sell contracts which represent a particular amount of a cryptocurrency. Each contract has a specific expiration date, at which point the contract will be settled and profits or losses will be made according to the difference between the contract price and the market price at the expiration date.

To start trading, users first need to create an account and deposit Bitcoin, which can then be used to purchase contracts. Users can place 'Long' or 'Short' orders, predicting that the price of the cryptocurrency will go up or down, respectively. The platform also offers leverage, allowing traders to borrow funds for placing larger orders. However, this feature also increases the potential for larger losses.

Orders on BMEX are matched using an order book system, and the platform employs engine technology with high transaction throughput, which ensures quick and efficient order processing. Once the order is complete, the transaction is recorded on the blockchain. Although the platform operates 24/7, withdrawals are only processed once a day to maintain high security standards.

Overall, BMEX offers a complex and advanced trading system for experienced traders who are interested in speculating on cryptocurrency prices.

What Makes BMEX Unique?

BMEX offers several unique features and innovations that distinguish it from other trading platforms in the cryptocurrency space.

1. Futures Contracts: One of its unusual features is the offering of futures contracts. These contracts allow traders to bet on the future price of various cryptocurrencies, without needing to own the digital asset. This provides potential for substantial profit, but also comes with significant risk.

2. Leverage Trading: BMEX also offers high leverage ratios, up to 100x, compared to many other platforms. This allows users to enter into positions larger than their account balance, potentially amplifying profits. However, it also significantly increases risk.

3. Engine Technology: BMEX utilizes a highly efficient trading engine technology, which ensures quick and efficient order matching and processing.

4. Off-peak Margin Trading: The Platform also introduces Off-peak margin trading hours where traders will be able to receive a discount on trading fees. This model incentivizes traders to execute trades during off-peak hours.

5. Security Measures: BMEX's robust security protocols, including multi-signature withdrawal processes, mandatory daily withdrawals, and extensive risk checks, are an innovative approach in a market often criticized for security issues.

However, it's important to note that while these features and innovations provide valuable opportunities for traders, they also come with elevated risks, particularly for inexperienced traders and should be approached carefully.

How to sign up?

To sign up for BMEX, you need to:

1. Visit the BMEX or BitMex website.

2. Navigate to the 'Register' button typically located in the top right part of the home page.

3. Provide your email address, preferred password, country of residence, and your full name in the corresponding fields.

4. Accept the terms and conditions and privacy notice after reviewing them.

5. Complete the CAPTCHA task to verify that you are not a robot.

6. You will then receive an email to the provided email address for confirmation. Follow the instructions within that email to verify your account.

7. Once your account is verified, you can go ahead to deposit Bitcoin into your account, and then you are set to begin trading on BMEX.

It's worth noting that BMEX does not currently accept traders from all countries, and as such, you should check if your country of residence is supported before attempting to create an account.

Can You Make Money?

BMEX clients can indeed potentially make money by participating in its futures trading program. However, the potential to make profits also comes with corresponding risks. Some useful advice for those considering participating includes:

1. Gain Knowledge: Understanding how futures trading works is crucial. Learn about it as much as possible before starting. BMEX has a comprehensive 'Help' section on their site that's worth studying.

2. Practice Risk Management: Trading futures is inherently risky. Implement risk management strategies to minimize potential losses. This can involve setting limits on the amount you're willing to stake on a particular trade and diversifying your trades instead of putting all your money on a single asset.

3. Start Small: If you're new to futures trading, start with small amounts until you are more comfortable and experienced with how the system works.

4. Understand Leverage: BMEX offers high leverage trading that can magnify profits but can also multiply losses. Be sure to understand this notion thoroughly before engaging in leverage trading.

5. Stay Updated: The cryptocurrency market is rapidly changing, and staying updated on market trends can be advantageous.

6. Consider the Drawbacks: Despite the potential gains, always be aware of potential losses and make sure you are comfortable with the level of risk involved in cryptocurrency trading.

It's important to note that while these pieces of advice can help, they do not guarantee profit. Trading futures is complex, and it is highly recommended that you only trade with what you can afford to lose.

Conclusion

BMEX, also known as BitMex, is a robust cryptocurrency trading platform that offers a wide range of features to its users. The platform's main attraction lies in its diverse offering of cryptocurrency contracts, superior security measures, and a high-performance trading engine. The introduction of innovative offerings like futures contracts and high leverage trading attracts experienced traders, but the complexity and high-risk nature of these trading options can be overwhelming for newcomers. The platform's ban in some countries, including the United States, and its lack of support for fiat currencies also limit its potential user base. Despite these challenges, BMEX remains a compelling choice for seasoned traders willing to navigate its intricate trading environment and manage its inherent risks.

FAQs

Q: What is BMEX?

A: BMEX, or BitMex, is a cryptocurrency trading platform that enables users to trade in Bitcoin and a variety of other cryptocurrencies using contracts.

Q: Who are the founders of BMEX?

A: The platform was established by Arthur Hayes, Ben Delo, and Samuel Reed in 2014.

Q: What are some primary benefits of using the BMEX platform?

A: BMEX provides a diverse selection of cryptocurrency contracts, a secure and stable trading environment, features devised by seasoned industry professionals, and serves a worldwide clientele.

Q: What kind of drawbacks can be associated with using BMEX?

A: Limited availability in certain countries like the United States, potentially overwhelming complexity for beginners, lack of fiat currency support, and an inherently high risk similar to other trading platforms are among the downsides of BMEX.

Q: How secure is BMEX?

A: BMEX utilizes several security measures, including a multi-signature deposit and withdrawal scheme, Amazon Web Services's security features, and maintaining most assets offline in air-gapped systems, among other measures.

Q: Can you explain how BMEX functions?

A: BMEX operates as a peer-to-peer marketplace for trading contracts that represent specific amounts of cryptocurrencies, using a high-capacity trading engine to quickly process and record all transactions.

Q: Does BMEX offer any unique features or innovation?

A: Yes, BMEX distinguishes itself by offering futures contracts, high leverage ratios, efficient trading engine technologies, off-peak margin trading, and robust security protocols.

Q: How do I sign up for BMEX?

A: Visit the BMEX website, complete the 'Register' form with your information, agree to the terms and conditions, complete a CAPTCHA, and verify your account via email.

Q: Is it possible to earn money through BMEX?

A: Yes, clients can potentially make profits on BMEX through futures trading, but this comes with high risk and should be approached with comprehensive knowledge and caution.

Q: How would you summarize BMEX's platform and offerings?

A: BMEX is a complex, feature-rich crypto trading platform that offers a diverse range of contracts and strong security measures, making it appealing to experienced traders, but its technical complexities and high-risk nature may pose challenges to beginners.

Risk Warning

Investing in blockchain projects carries inherent risks, stemming from the intricate and groundbreaking technology, regulatory ambiguities, and market unpredictability. Consequently, it is highly advisable to conduct comprehensive research, seek professional guidance, and engage in financial consultations before venturing into such investments. It's important to be aware that the value of cryptocurrency assets can experience significant fluctuations and may not be suitable for all investors.

Website

Most visited countries/areas

Japan

bmex.vip

Server Location

United States

Most visited countries/areas

Japan

Domain

bmex.vip

ICP registration

--

Website

-

Company

-

Domain Effective Date

--

Server IP

108.160.166.9

bmexpro.com

Server Location

United States

Most visited countries/areas

--

Domain

bmexpro.com

ICP registration

--

Website

WHOIS.REGISTRAR.AMAZON.COM

Company

AMAZON REGISTRAR, INC.

Domain Effective Date

2020-04-24

Server IP

199.59.150.12

Content you want to comment

Please enter...

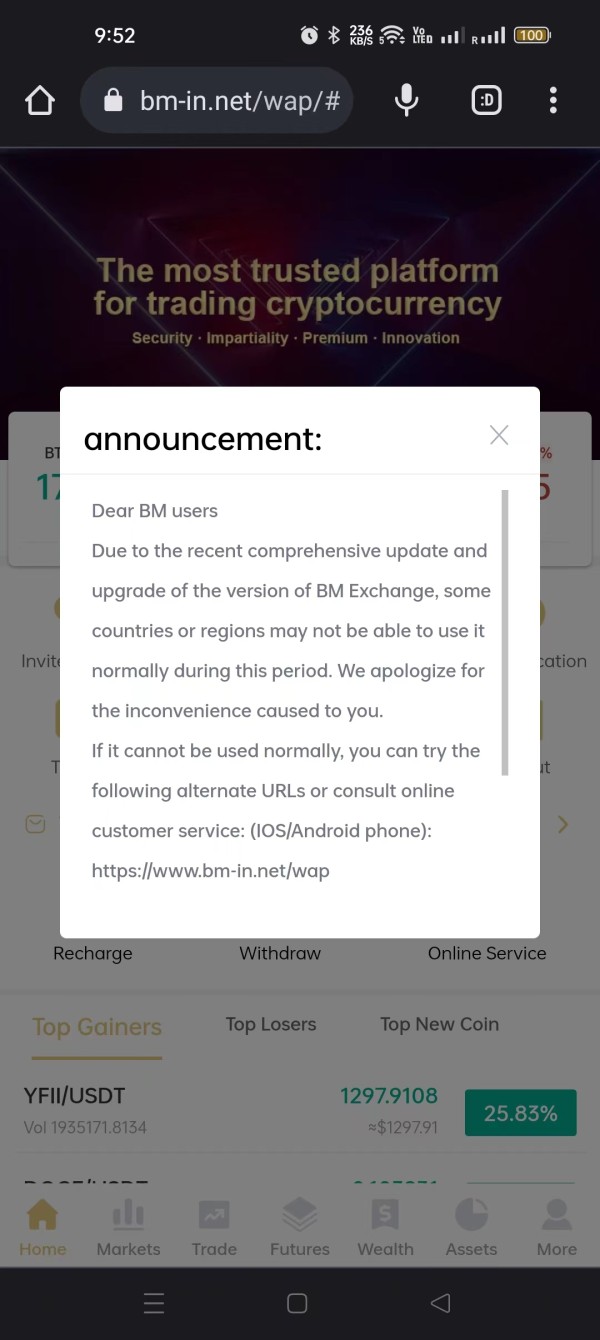

BIT1423220041

2022-12-06 10:52

1) When withdrawing coins, it said that there was a lack of transaction volume of 3,000. After two days, I aksed customer service and said that there was a lack of transaction volume of 3,500. 2) After making a transaction volume of 3,000, go to withdraw, and after 24 hours, you can no longer log in to the platform. 3) It is said that the platform is upgrading, ask customer service, why can't I log in? After submitting the ID number, the customer service closes the dialog window.

Exposure