Overview of QZ Asset Management

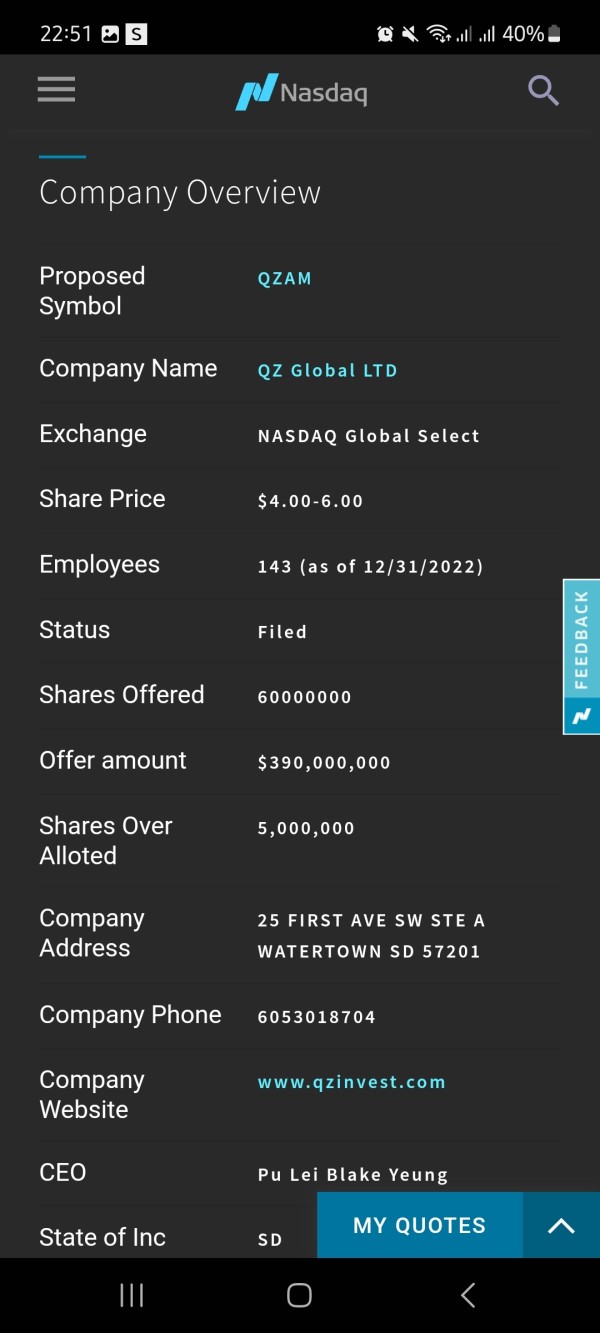

QZ Asset Management is a global financial firm that was specifically designed to tackle the challenges of managing digital assets on the blockchain. The firm provides a robust platform for managing various digital assets, offering comprehensive services that include fund investment, portfolio management, and asset custody among other services. The QZ Asset Management team comprises individuals with diverse backgrounds spanning business management, finance, computer science, and blockchain technology. This unique mix of expertise equips the company with a broad range of understanding in managing both traditional and digital assets.

Pros and Cons

| Pros | Cons |

| Global reach | Lack of physical locations |

| Comprehensive services for digital asset management | Relatively new in the market |

| Diverse team with multiple areas of expertise | Operational risks associated with managing digital assets |

| Combination of traditional and digital asset management | Regulatory uncertainties in the blockchain industry |

Security

QZ Asset Management takes security seriously and as such, employs several measures to ensure that the digital assets under their custody are secure. A key component of their security strategy involves using advanced encryption techniques which helps to protect against hacking attempts and ensures the safe transmission of information. Furthermore, they leverage multi-signature wallets for fund storage, which require multiple keys to authorize transactions, thus safeguarding against unauthorized transactions.

As part of their risk management practice, QZ Asset Management also conducts regular internal audits and network stress tests to identify and fix potential vulnerabilities. To further bolster their defenses, the firm adheres to regulatory compliance and implements strict access control measures, employing measures like two-factor authentication and user identity verification.

How Does QZ Asset Management Work?

QZ Asset Management operates as a comprehensive platform for managing, investing, and securing digital assets. They primarily serve clients who are seeking to invest or manage their assets in the digital or blockchain industry.

Their primary process starts with identifying client needs and creating a tailored financial plan. Utilizing their global network and industry knowledge, they direct investments into profitable digital assets, while providing regular financial advice and market updates to their clients.

As part of their asset management service, they store these digital assets securely, using the latest encryption techniques and multi-signature wallets for fund storage, which require multiple keys to authorize transactions. This safeguards the assets from unauthorized transactions.

What Makes QZ Asset Management Unique?

QZ Asset Management deploys a variety of unique features and innovations in its operation. Firstly, the firm combines traditional and digital asset management strategies, thus catering to the financial needs of clients in an era of increasing digitization. Its expertise in both spheres enables it to offer diverse and adaptable service solutions.

Secondly, the firm exploits blockchain technology to ensure transparency and integrity in its operations. Information relating to transactions and investments made by clients can be audited and verified on the blockchain, which provides an added layer of security and trust.

Thirdly, QZ Asset Management has developed a proprietary platform for digital asset management. This platform allows clients to track their investments, access frequent reports and monitor the market trends in real time.

Lastly, QZ Asset Management prides itself on being a globally-operating firm. This allows them to tap into international markets, navigate different market dynamics and provide a global perspective to their clients. This feature significantly broadens the investment opportunities available to their clients.

How to Open an Account?

Opening an account with QZ Asset Management involves a straightforward process that can be completed online. Follow these steps to open your account:

- Visit the QZ Asset Management website: Navigate to the official website of QZ Asset Management.

- Locate the “Open Account” option: Look for the “Open Account” or “Sign Up” button, typically found in the top right corner of the homepage or on the main navigation menu.

- Provide personal information: Complete the registration form with accurate information, including your full name, email address, phone number, country of residence, and preferred language.

- Verify your identity: Upload a clear copy of your government-issued ID, such as a passport or driver's license, to verify your identity.

- Set up your account security: Establish a strong password for your account and consider enabling two-factor authentication for enhanced security.

- Link your preferred payment method: Connect your bank account or other preferred payment method to facilitate deposits and withdrawals.

- Review and agree to terms and conditions: Carefully read and agree to the terms and conditions governing your account with QZ Asset Management.

- Submit your application: Once you've completed all the steps and verified the information, submit your application for review.

- Await account approval: QZ Asset Management will review your application and notify you of the approval status via email.

Once your account is approved, you can start investing in QZ Asset Management's products and services. Remember to thoroughly research and understand the investment risks involved before making any investment decisions.

Content you want to comment

Please enter...