Overview of WealthStock Exchange

WealthStock Exchange is a pioneering blockchain-based platform aimed at creating an advanced financial ecosystem. It leverages blockchain technology to establish an open and decentralized market for individual investors, institutions, and businesses worldwide. The core mission of WealthStock Exchange is to democratize the financial landscape by making it more inclusive and accessible.

As for the founders, WealthStock Exchange was started by a team of blockchain enthusiasts and financial experts who came together from different parts of the world. Their diverse backgrounds and collective experience have been essential in shaping the unique approach that defines WealthStock Exchange today.

Their commitment to transparency, security, and user-friendliness is evident in the innovative features integrated into the platform, which allows users to trade various financial assets in a secure and seamless manner. Thanks to blockchain technology, WealthStock Exchange provides an immutable and transparent record of all transactions, which adds an extra layer of trust to the ecosystem.

In terms of its regulatory status, WealthStock Exchange operates by fitting into the existing laws and regulations of the jurisdictions in which it operates. The entity also engages in continuous discourse with regulatory bodies to ensure the best interests of its users are secured.

The platform's native digital asset plays a pivotal role in its functioning, serving as a medium of exchange and providing various benefits to its holders.

Overall, WealthStock Exchange is a major contributor to the emerging blockchain-based financial systems, driving industry advancements through its novel approach to asset exchange.

Pros and Cons

| Pros | Cons |

| Blockchain-based infrastructure | Dependent on blockchain scalability |

| Simplified asset trading | Market volatility risks |

| Transparency of transactions | Adherence to multiple jurisdiction regulations |

| Security of user assets | Limited control over user behaviours |

| Diverse types of financial assets | Potential for regulatory scrutiny |

Pros:

1. Blockchain-based infrastructure: WealthStock Exchange is built on a blockchain-based platform, which democratizes the financial landscape and ensures transparency in transactions. Blockchain's immutable nature enhances trust in the system and reduces fraud and manipulation.

2. Simplified asset trading: The platform caters to individual investors, institutions, and businesses and simplifies the trading of various financial assets. This opens up opportunities for many who were blocked out of the traditional financial ecosystem.

3. Transparency of transactions: Blockchain technology enables transparent transactions where every participant can verify the transactions without any intermediary. This transparency provides an extra layer of trust and reduces the risks of manipulation.

4. Security of user assets: WealthStock Exchange prioritizes the security of user assets. The use of blockchain technology helps in enhancing security measures by adding varied and robust defense mechanisms.

5. Diverse types of financial assets: WealthStock Exchange provides access to trade various kinds of financial assets. This inclusivity increases the options for the investors and widens the scope of the platform.

Cons:

1. Dependent on blockchain scalability: The performance and scalability of WealthStock Exchange are dependent on the underlying blockchain technology. As more users join the platform, there might be scalability issues, which could affect the user experience.

2. Market volatility risks: The blockchain market is known for its high volatility. The users of the exchange are therefore exposed to market risks, which they need to consider while trading.

3. Adherence to multiple jurisdiction regulations: As WealthStock Exchange is active in multiple jurisdictions, it has to comply with different sets of regulations, which could be complex and challenging.

4. Limited control over user behaviors: While the platform provides an open environment for trading, it has limited control over user behavior. In case of malicious activities by users, corrective actions could be difficult and time-consuming.

5. Potential for regulatory scrutiny: As digital assets and blockchain-based platforms are still new territories for most jurisdictions, the platform could face regulatory scrutiny and changes in regulations can impact its operations.

Security

WealthStock Exchange employs a number of security measures to safeguard user assets and personal data. Their security measures incorporate a strong technological and operational approach to ensure the integrity of transactions and the safety of assets.

From a technological perspective, the use of blockchain technology itself offers a greater degree of security. Blockchains are designed to be immutable and tamper-proof, meaning once a transaction is recorded and verified, it cannot be altered or deleted. This inherent value of blockchain technology adds a robust level of security to the platform.

WealthStock Exchange also employs techniques like multi-signature wallets and two-factor authentication. Multi-signature wallets require more than one key to authorize a transaction, which provides an added layer of security. Two-factor authentication, on the other hand, involves a second check to verify a user's identity during the sign-in process.

Operationally, WealthStock Exchange acknowledges the importance of regulatory compliance. It operates based on the laws and regulations of the jurisdictions in which it's active. Compliance with these regulations entails certain mandatory security measures as well, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) measures.

However, despite these measures, security isn't absolute in any system, including the blockchain. It's also important to note that the security of the user's own wallet and private keys is as critical as any provided security measure. Users should always treat their private keys with the same level of care as they would with other sensitive personal information. They should also avoid sharing it with others to prevent unauthorized access and potential loss of assets.

In terms of evaluation, WealthStock Exchange has shown a significant commitment to user security. While it leverages the inherent security of blockchain technology, it has also implemented additional security techniques and prioritizes compliance with regulatory requirements. However, the platform security is heavily dependent on the behavior of its users — particularly how they manage their private keys. Therefore, the platform might seek to enhance user awareness and education concerning proper security practices.

How Does WealthStock Exchange Work?

WealthStock Exchange functions as a decentralized marketplace for trading various financial assets, utilizing blockchain technology to ensure transparency, security, and fairness.

Here is a simplified breakdown of how it operates:

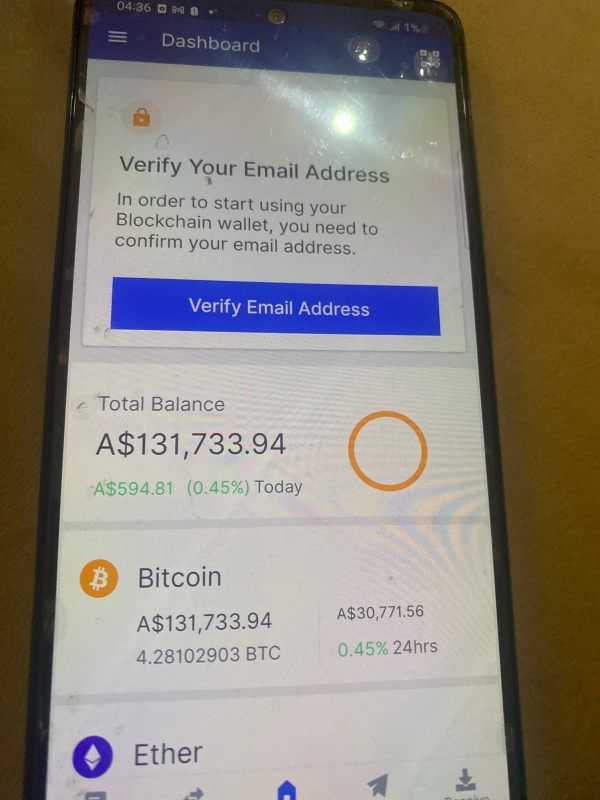

1. Registration: Users start by creating an account on the platform, which involves a mandatory KYC (Know Your Customer) procedure for identity verification as a part of adherence to standard regulatory requirements.

2. Wallet setup: After account setup, users set up their digital wallets on the platform or link an existing one. This wallet is used to hold and manage their digital assets.

3. Deposits: With wallets ready, users can now deposit funds. The funds can be deposited in the form of the platform's native cryptocurrency or other supported digital currencies.

4. Trading: Once the funds are confirmed within the account, users can begin trading. They can buy or sell a variety of financial assets available on the platform.

5. Order matching: The exchange employs an automated order matching system that pairs buy and sell orders based on price and order type. When the criteria of a buy order and a sell order match, the system executes the trade.

6. Settlement: Once trades are executed, the system instantly updates the digital wallets of the seller and purchaser, finalizing the transaction. The blockchain technology ensures that all these transactions are recorded permanently and transparently.

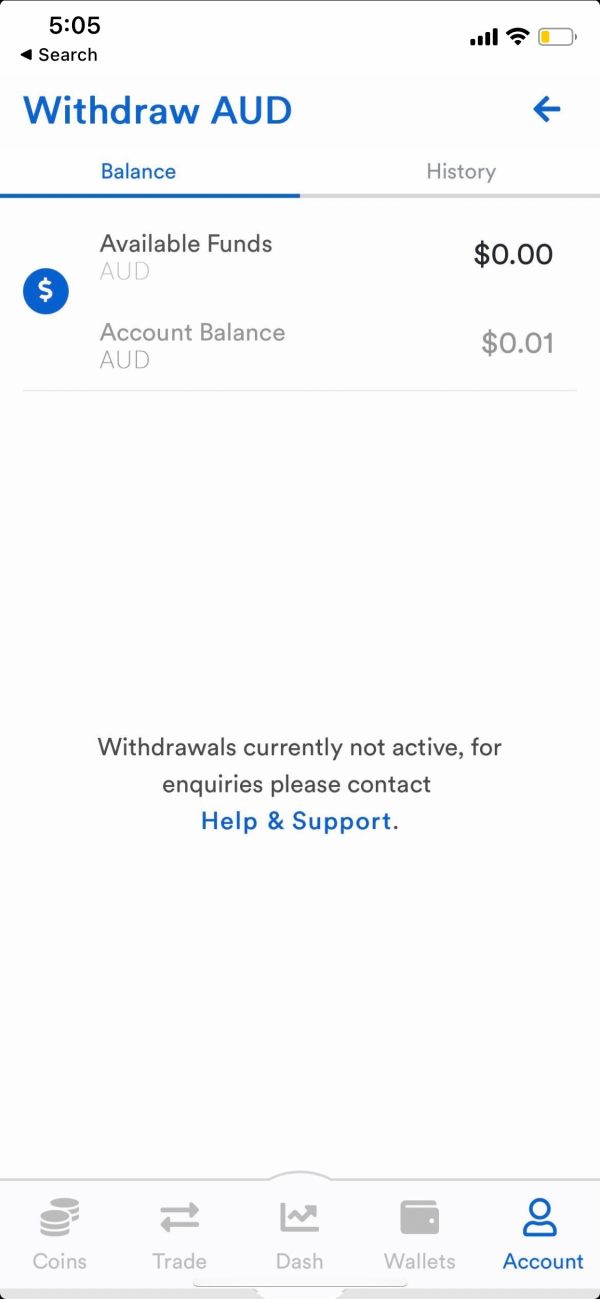

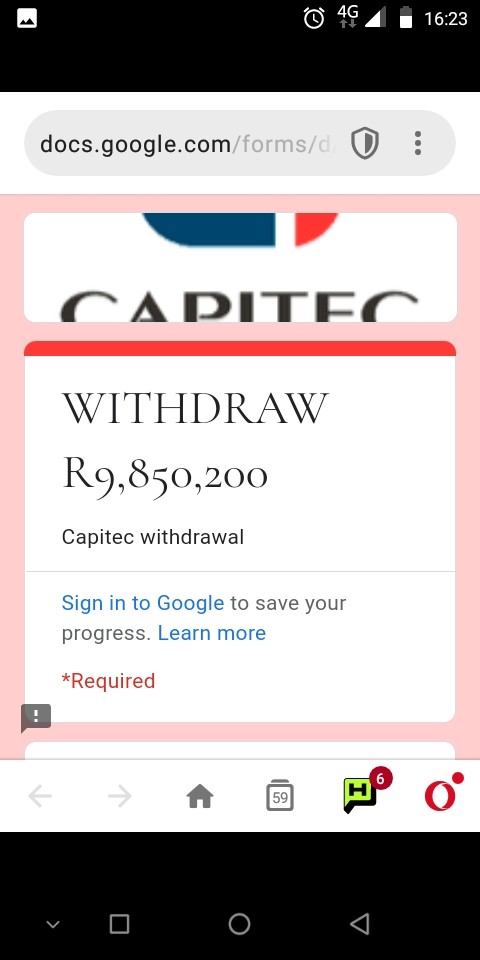

7. Withdrawals: Users can withdraw their funds in the form of digital assets to their private wallets at any time. It's important to note that withdrawal transactions might require additional verification steps for added security.

By bringing together individual investors, institutions, and businesses on a singular platform, WealthStock Exchange aims to create an inclusive and accessible financial ecosystem.

What Makes WealthStock Exchange Unique?

WealthStock Exchange is marked by several unique features and innovative implementations that differentiate it from traditional financial platforms:

1. Blockchain Technology: WealthStock Exchange leverages the power and potential of blockchain technology to establish a transparent and decentralized financial ecosystem, which brings a higher level of openness to the market operations compared to traditional mechanisms.

2. Advanced Security Measures: The platform incorporates advanced security measures such as multi-signature wallets and two-factor authentication, to shield against potential threats and fraud attempts, always seeking the best ways to ensure user assets and information safety.

3. Diverse Financial Assets: WealthStock Exchange doesn't limit itself to cryptocurrency trading. It provides a broad spectrum of financial assets, ranging from securities, bonds, commodities to other complex instruments, giving users a wider array of options for diversification.

4. Regulatory Compliance: While operating in a field that is still largely unregulated worldwide, WealthStock Exchange makes a conscious effort to adhere to existing laws and regulations in the jurisdictions it serves. This gives an additional layer of trust and credibility to the platform.

5. User-friendly Interface: Despite being a sophisticated blockchain platform, WealthStock Exchange presents a user-friendly interface that simplifies the trading process, making it accessible to both novice and experienced investors.

6. Innovative Financial Products: Beyond traditional asset trading, WealthStock Exchange is also pioneering new financial products unique to the blockchain ecosystem. These innovative offerings further its goal of democratizing the financial landscape and fostering financial inclusivity.

How to sign up?

To sign up on WealthStock Exchange, you must follow the steps below:

1. Visit the official website of WealthStock Exchange.

2. On the homepage, locate and click on the 'Sign Up' button, usually located in the top right corner of the webpage.

3. You will be directed to a registration page where you will need to fill out your personal details such as name, email address, and create a password.

4. Once you've filled in all the required details, you may need to agree to the terms and conditions before proceeding. Make sure to read through these carefully.

5. Click on the 'Submit' or 'Sign Up' button to complete the initial registration process.

6. A verification email will be sent to the registered email address. Navigate to your inbox, open the email from WealthStock Exchange, and click on the verification link to verify your email address.

7. After successful verification, you will be asked to complete a Know Your Customer (KYC) process. This typically involves submitting identification documents to verify your identity and may also require proof of address.

8. After successfully completing the KYC process, your account will be fully activated. You can then log in to your account and start exploring the WealthStock Exchange.

Please note, the exact process may vary slightly based on the platform's policy changes and updates. Always ensure to protect your personal details and avoid sharing your login credentials with anyone.

Can You Make Money?

Participating in WealthStock Exchange provides an opportunity for clients to potentially earn profits by trading various financial assets. However, it's important to remember that this is not a guaranteed outcome as the financial markets are inherently volatile and can expose participants to potential losses.

When it comes to making money, the strategy taken by the client will play a crucial role. Here are a few useful tips:

1. Education: Before diving in, get familiar with the platform, understand how the market operates, and stay informed about the assets you are interested in. Use the platform's educational resources and guides to acquire an understanding of blockchain and financial principals.

2. Diversification: Diversify your investment portfolio by investing in different kinds of assets. This strategy can potentially reduce risk.

3. Careful Risk Management: Decide on the level of risk you can tolerate. Take careful measures to manage potential losses by setting stop losses and carefully monitoring your trades.

4. Stay Updated: Keep track of market trends and news. This can help you to make informed decisions.

5. Regular Review: Regularly review and adjust your portfolio based on performance and market changes.

6. Consultation: If you're feeling uncertain or confused, consider seeking help from financial advisors or take courses to enhance your trading skills.

Lastly, it's important to not invest more money than you can afford to lose. Regardless of potential profits, investing in trading platforms always carries some level of risk. It is crucial to approach any investment decision with purpose, patience, and an informed perspective.

Conclusion

WealthStock Exchange is a proactive entity in the evolving blockchain-based financial landscape, offering a platform for trading various financial assets. Its blockchain-powered infrastructure brings transparency and security to transactions, making it favorable for users. Despite facing challenges like potential scalability issues, high volatility, and the complexity of complying with multiple jurisdiction regulations, the exchange continues to demonstrate adaptability and innovation in its approach. The platform's transformative features and commitment to advanced security measures underscore the mission of democratizing financial systems. Nonetheless, as with all investment platforms, users should practice responsible trading, risk management, and ensure they have a thorough understanding of the platform and the assets they are dealing with.

FAQs

Q: What is the main purpose of WealthStock Exchange?

A: WealthStock Exchange serves as a blockchain-based platform enabling secure and transparent trading of numerous financial assets for individuals, businesses, and institutions.

Q: Who set up WealthStock Exchange?

A: WealthStock Exchange was established by a coalition of financial professionals and blockchain enthusiasts hailing from various parts of the globe.

Q: How does WealthStock Exchange ensure the security of transactions?

A: Through the inherent security features of blockchain technology and added security measures such as multi-signature wallets and two-factor authentication, WealthStock Exchange ensures secure transactions.

Q: What are the potential downfalls of using WealthStock Exchange?

A: Some possible challenges can include dependency on blockchain scalability, susceptibility to market volatility, complex multi-jurisdiction regulations, and potential regulatory scrutiny.

Q: What does WealthStock Exchange do to secure user assets?

A: WealthStock Exchange deploys advanced security mechanisms including blockchain technology, multi-signature wallets, two-factor authentication, and strict adherence to compliance regulations.

Q: How does WealthStock Exchange function?

A: WealthStock Exchange operates as a decentralized marketplace, where after account setup, users deposit funds, trade various financial assets, and settle transactions through an automated system, with blockchain technology ensuring a secure, immutable record of transactions.

Q: What are the steps to register on WealthStock Exchange?

A: To register, you visit WealthStock Exchange's official website, complete the registration form, verify your email, complete the KYC process, and upon successful completion, your account will be activated.

Q: Can you summarize WealthStock Exchange briefly?

A: WealthStock Exchange is a blockchain-based platform facilitating the global trade of diverse financial assets in a secure and transparent manner, despite facing challenges such as blockchain scalability issues, market volatility, and complex regulations, it continues to innovate and adapt, promoting a democratized financial system.

Risk Warning

Investing in blockchain projects carries inherent risks, stemming from the intricate and groundbreaking technology, regulatory ambiguities, and market unpredictability. Consequently, it is highly advisable to conduct comprehensive research, seek professional guidance, and engage in financial consultations before venturing into such investments. It's important to be aware that the value of cryptocurrency assets can experience significant fluctuations and may not be suitable for all investors.

Content you want to comment

Please enter...